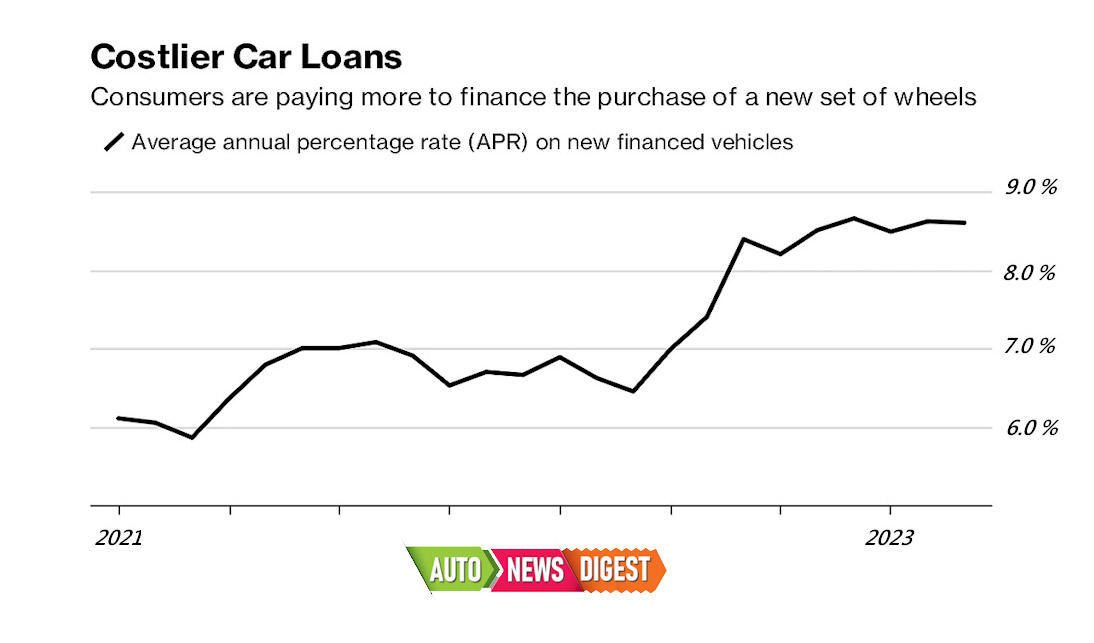

Interest rate hikes by the Fed is certainly increasing the cost of financing a car for consumers. It has becomes more expensive for borrowers to take out loans, including car loans. This leads to higher monthly payments, longer loan terms, or even loan denials for some consumers.

To mitigate the impact of interest rate hikes on car financing, smart consumers are shopping around for the best interest rates and loan terms, and the best price for their new purchase.

They are also considering options like leasing a car, which can provide lower monthly payments and shorter terms than traditional car loans. Additionally, consumers can work on improving their credit scores and overall financial health, which can help them qualify for better loan terms and lower interest rates in the future.

Auto dealerships may want to consider adjusting their pricing strategies or diversifying their inventory to better align with changing market conditions and improve their overall financial stability.

But the problem may not all be contributed to consumer credit rating or auto loan companies increasing their rates due to increase in Fed interest rate.

With rapidly changing market valuation of automobiles and consumer demand and supply, inaccurate auto book values can certainly hinder dealerships’ ability to secure financing for consumers, as lenders often rely on book values to underwrite loans and determine interest rates – which may not coroberate with the valuation expected by dealerships or the price paid at wholesale auctions.

If book values are not accurately reflecting the true value of used vehicles, this can lead to higher interest rates or even loan denials, making it harder for consumers to purchase the vehicles they want.

Dealerships are facing fluctuating market conditions with auto pricing. The used car market is constantly changing, with supply and demand factors, consumer preferences, and other market forces all affecting prices which also affect the new car pricing. If book values are based on outdated or inaccurate information or dealer assessment, this could lead to discrepancies between the book values and actual market prices.

The accuracy of book values can depend on the quality of the underlying data, which is based on demand and supply. If the data used to calculate book values is incomplete, outdated in some way, this could lead to inaccuracies.

Auto dealerships need to invest in better data analysis tools or work with third-party valuation services or wholesale auctioneers to get more accurate valuations of their used vehicles.

They may also need to work closely with lenders to explain any discrepancies between book values and actual market prices and negotiate better loan terms for their customers.