According to a recent J.P. Morgan Research study, vehicle prices and inflationary effects will continue to be the biggest factor in determining prices in 2023. Car prices have accelerated in recent months, as with many other consumer goods although they are expected to fall by the end of 2023.

The study is also in agreement with the figures from data analytics firm J.D. Power, both confirming that the average price paid for a new vehicle in the U.S. was up 4.2% year-over-year in January 2023. Combined with soaring gasoline prices and interest rates, this is making car ownership more onerous and putting the brakes on auto sales, and therefore reducing demand for new or used cars by the end of this year.

Q1 cars sales performance

In the same study, J.P. Morgan Research examines why car prices have been rising, how inflation is impacting car sales trends and when car prices are expected to drop.

- New car prices are rising as a result of higher production costs. In the U.S., the average price of a new vehicle was up 4.2% year-over-year in January 2023.

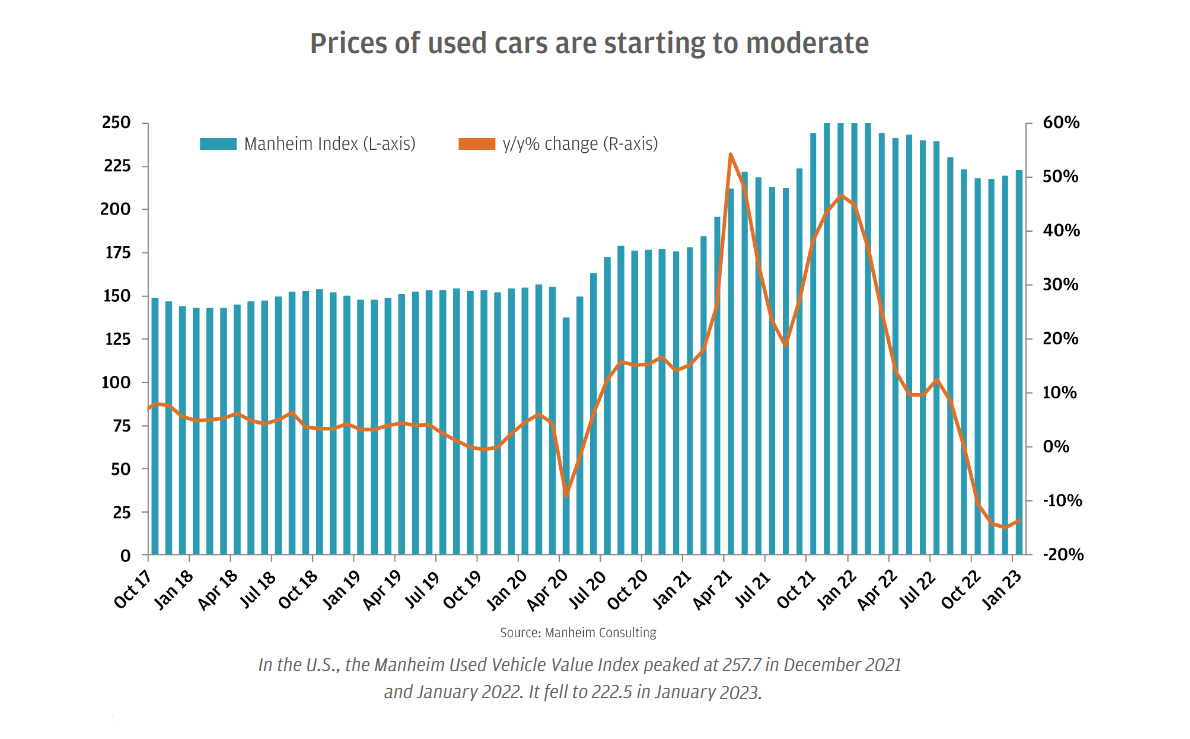

- This has fueled demand for used cars, with average prices tracking around 30% above pre-pandemic levels.

- Used car prices have likely peaked, but new car prices are expected to remain high. In 2023, prices are expected to decline by roughly 10% for used cars and by 2.5% to 5% for new cars.

The chip shortage influence

Car prices rose dramatically in 2022 as a result of global supply chain issues, with a persistent semiconductor shortage holding up production in the auto industry, in particular in Europe and U.S.

While semiconductor supply is improving and it is further expected to improve for the remainder of 2023, still new car prices will likely remain elevated due to inflationary input costs.

On average American car buyers spent $46,437 for a new vehicle in January 2023, marking a year-over-year increase of 4.2%, according to data from J.D. Power. This is an all-time high for the month of January and indicates no real relief from 2022’s record prices. There are also still shortage in the used car market.

Less linear than normal auto industry trends by the end of 2023

The study estimates the average transaction price of a new vehicle in the U.S. to decline by around 2.5% to 5% year-over-year by end of 2023, supported by increasing inventory availability as supply constraints ease and as automakers produce more lower-end models equipped with fewer high-end features.

This represents a more normal mix relative to the past several years, when the preference was for the production of high-end models as interest rates climb and recession sets in.

It is expected that the auto industry will continue to experience a “lower volume, higher price” retail sales projection.

The road to recovery may be less rapid and less linear than the normal auto industry trends while 2023 has greater potential for a more rapid improvement in the volume environment. J.P. Morgan Research on 2023 vehicle prices and inflationary pressures suggests a more rapid normalization in pricing, with the wildcard being an economic slowdown.