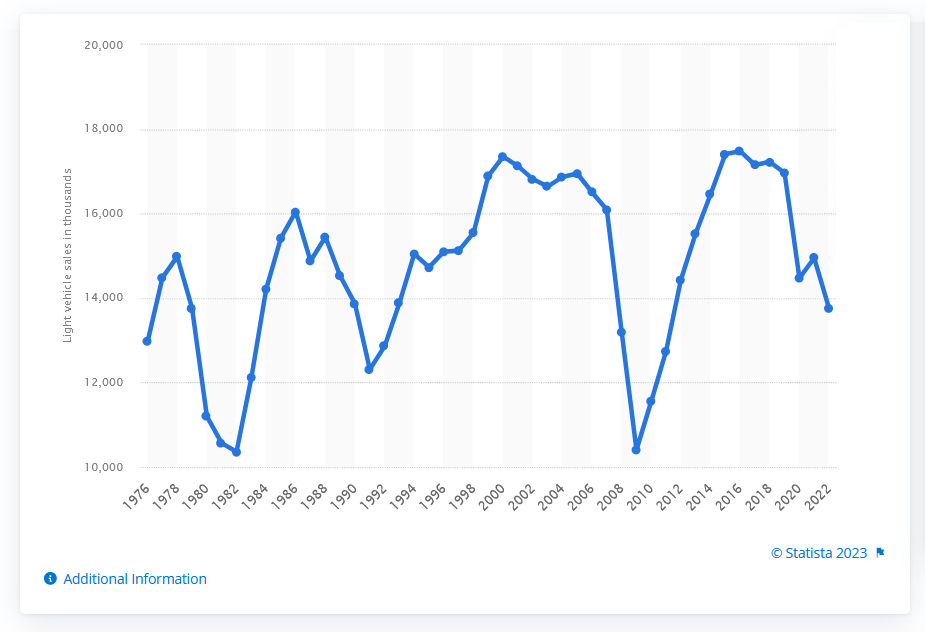

2022 Revenue by major auto makers was still on the downward trend. However, some car manufacturers did better than others.

Toyota Motor Corp sold 10.5 million vehicles in 2022, it said yesterday, defending its title as the world’s top-selling automaker for a third straight year.

Ford sales increased 7% year-over-year worldwide, and surpassed Honda and Nissan on the top 15 list. To add to their fortunes, Ford U.S. sales rose 22% year-over-year in February 2023, bolstered by a healthier flow of new-vehicle inventory. The Dearborn automaker sold 157,606 vehicles last month, up from 129,273 in February 2022. Through the first two months of the year, sales are up 11.4%.

Renault had a difficult year, down 24%, hindered by the removal of its brand from the Russian market. In France, Renault remained the company’s largest market, accounting for 335,971 units in 2022. It was followed by Brazil (126,689 units), Germany (100,338 units) and Turkey (99,639 units) in the second, third and fourth spots, respectively.

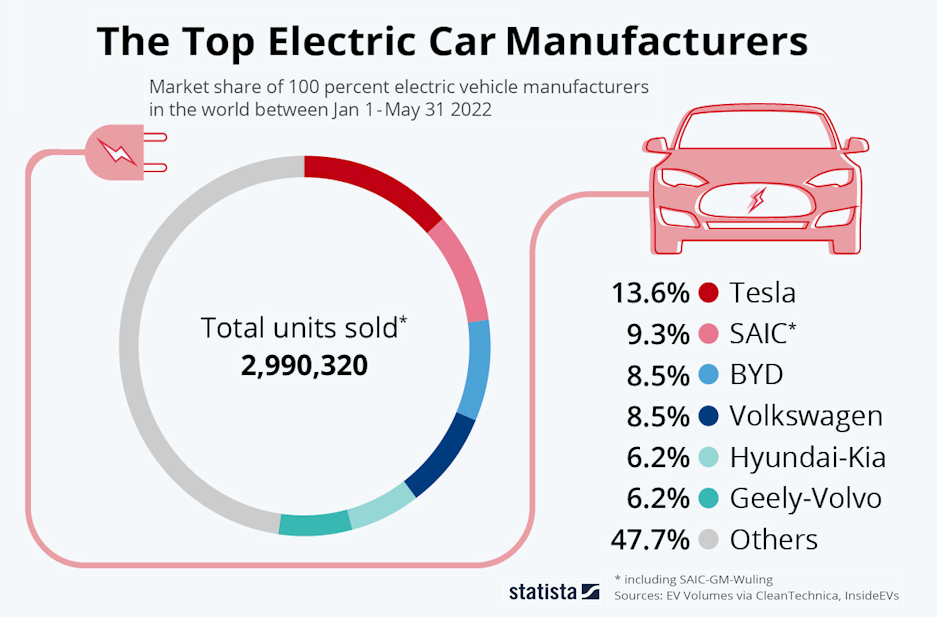

Tesla sold over 1 million vehicles for the first time in history in 2022, up 47% worldwide, and ranked #15 by volume on the list of global automakers. In 2022, Tesla delivered 1,313,581 vehicles. This is almost the same deliveries as 2021 has in total. There has been a 4.85x increase in Tesla deliveries from 2017 – 2022.

According to Statista, the top worldwide car sales by manufacturer in 2022, based on the number of cars sold, were:

Toyota – 10.5 million vehicles sold

Volkswagen – 9.2 million vehicles sold

Hyundai Kia – 6.8 million vehicles sold

Stellantis (formerly Fiat Chrysler Automobiles) – 6.0 million vehicles sold

General Motors – 5.9 million vehicles sold

Ford – 4.2 million vehicles sold

The automotive industry has been facing supply chain disruptions ever since the COVID-19 pandemic and other factors such as semiconductor shortages. While the situation may improve in 2023, the possibility of supply chain challenges cannot be ruled out completely.

As for the shift towards electric vehicles (EVs), many automakers have been investing heavily in the development and production of EVs in recent years. The demand for EVs is expected to grow as countries around the world implement regulations to reduce carbon emissions and promote sustainable transportation.

Collaboration and alliances between automakers could potentially help to address supply chain challenges and accelerate the transition towards EVs. However, the success of such alliances would depend on a variety of factors, including the willingness of the companies involved to cooperate and share resources.

Overall, it is likely that the shift towards EVs will continue to be a major trend in the industry, and manufacturers that are able to produce high-quality EVs at a competitive price point will be well-positioned for success. However, the industry is also likely to face challenges related to regulatory changes, technological advancements, and changing consumer preferences, which could impact the market dynamics.